06 Feb 2019

TP Doc Series:

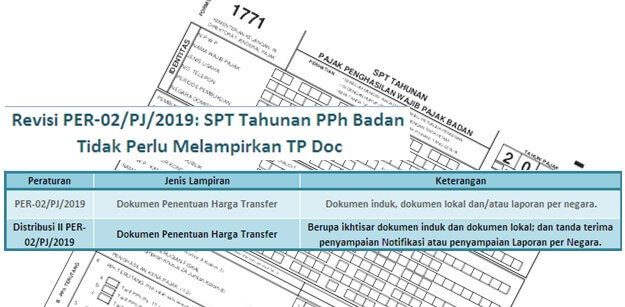

Revision PER-02 / PJ / 2019: Annual Corporate Income Tax Return Do Not Need To Attach TP Doc

Amendement of the Director General of Taxes Regulation Number PER-02 / PJ / 2019 (Distribution II) has answered the question whether the Annual Corporate Income Tax Return has to attach a Transfer Pricing Documentation (TP Doc). In connection with the previous information that the Annual Corporate Income Tax Return must attach a TP Doc (consisting of Master File, Local File and / or Country by Country Reports) in accordance with Attachment II letter J number 14 Director General of Tax Regulation Number PER-02 / PJ / 2019.

Distribution II PER-02 / PJ / 2019 confirmed that the Annual Corporate Income Tax Return is sufficient to attach an overview of the Master File and Local File and receipts of submission of Notifications or Country by Country Reports. Although they are not attached to the Annual Corporate Income Tax Return, the Director General of Taxes is still have the authority to request Master File and Local File. Thus, taxpayers are still required to provide TP Docs in accordance with the provisions stipulated in Article 4 of the Minister of Finance Regulation Number 213 / PMK.03 / 2016.

Best Regards,

ATT Consulting

Registered Tax Consultant

BVD Oriana User

Read Other Updates

-

Konversi Utang Menjadi Saham

27 Mar 2020

-

Pengangkatan Direksi Yang Cacat Hukum

10 Mar 2020

-

Sistem Perizinan Angkutan Laut SIUPAL Terintegrasi Online

17 Jan 2020

-

Tak Sampaikan LKPM, NIB dan Izin Usaha Terancam Dicabut

20 Dec 2019

-

Regulasi Terbaru: Kewajiban Menunjuk Perwakilan Dagang bagi E-Commerce Luar Negeri di Indonesia

13 Dec 2019

-

Total Investasi Yang Wajib Diisi Pelaku Usaha Dalam Sistem OSS Versi 1.1

14 Nov 2019

-

Ditiadakannya Kolom KBLI 2 Digit Akibat Implementasi OSS Versi 1.1

07 Nov 2019

-

Regulasi Baru: Merger Dan Akuisisi Aset Wajib Lapor KPPU

01 Nov 2019