28 Nov 2017

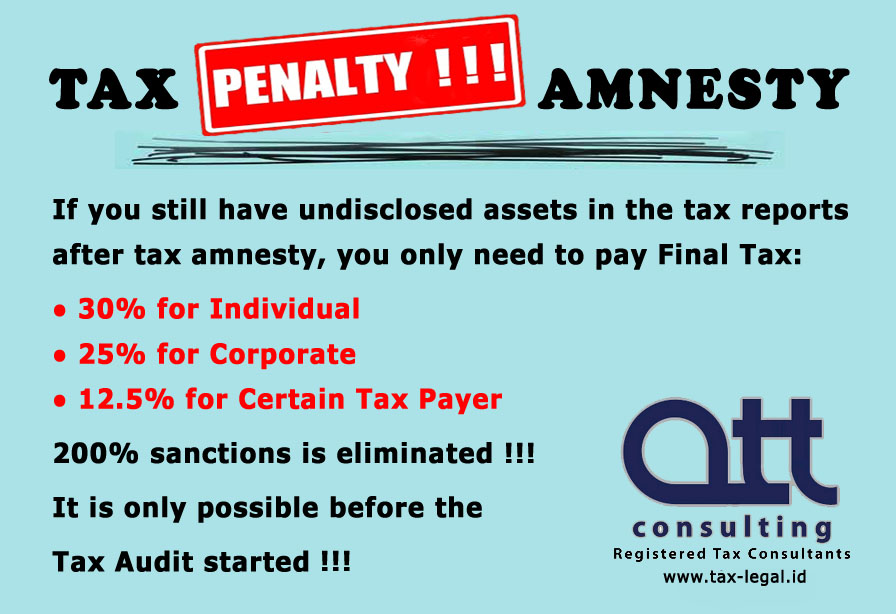

Tax Penalty Amnesty !!!

Best Regards,

Agung Tjahjady SH, CLA, CPA, MM, BKP

Registered Tax Consultant, Advocate

+62 816 825 348

BVD Oriana User

Read Other Updates

-

Tax Penalty Amnesty !!!

28 Nov 2017

-

Presentation "Pembekalan Pajak Asosiasi“, 28 November 2017, @Hotel Century Park Senayan

28 Nov 2017

-

Taxation on P to P Lending

08 Nov 2017

-

Omnibus Law

10 Oct 2017

-

Issue Penting!!

02 Oct 2017

-

TP Docs Series

08 Sep 2017

-

Issue Penting!!

30 Aug 2017

-

Every Breath You Taxed

19 Jun 2017